Nigeria has failed to meet the 70 per cent financial inclusion target set for 2020, as 86 million adults were negatively affected by the COVID-19 pandemic.

This was disclosed yesterday at a webinar organised by Enhancing Financial Innovation and Access (EFInA).

In the new report titled, “EFInA Access to Financial Services in Nigeria 2020 Survey,” it was revealed that the growth marginally increased from 63.2 per cent to 64.1 per cent in the period under review.

Findings showed that in 2016, 58.4 per cent of Nigeria’s 96.4 million adults were financially included, comprising 38.3 per cent banked, 10.3 per cent served by other formal institutions and 9.8 per cent served by informal service providers.

In 2020, the most populous black nation had planned to capture 70 per cent of its adult population in the formal financial services sector and 10 per cent in the informal sector, but the novel coronavirus dealt a great blow to the mission.

Giving more insight, EFInA’s Chief Executive Officer, Ashley Immanuel, observed that amid the challenging economic circumstances, financial inclusion continued to grow incrementally, with more than half of Nigerian adults using formal (regulated) financial services for the first time.

She said, at the current progress rate, the National Financial Inclusion Strategy targets of 2020 would not be met until around 2030.

Immanuel, however, submitted that the country could achieve the goals much faster if it followed paths taken by other African nations, especially their mobile money strategies.

She observed that this could be done by creating a level playing field for a wide range of providers and fintechs to thrive besides encouraging partnerships among the providers.

The EFInA boss charged government to build on initial progress and drive faster financial inclusion growth through digital financial services like mobile money, even as surveys showed that use of digital financial services and agent networks started growing significantly between 2018 and 2020.

In her remarks, Deputy Governor, Financial Systems Stability (FSS), Central Bank of Nigeria (CBN), Aishah Ahmad, who defined financial inclusion as a strong lever for bridging income inequality, combating poverty and preserving social harmony, stated that the apex bank has been at the forefront of efforts to drive the initiative in the country through development and implementation of national financial inclusion strategy.

Ahmad, who is also chairperson of the Financial Inclusion Technical Committee, regretted that despite the humble progress, critical groups, women, especially rural dwellers and northern citizens, remained excluded.

Also speaking, the Economic Development Team Leader, Nigeria for United Kingdom’s Foreign, Commonwealth and Development Office, Gail Warrander, whose organisation funded the study, noted that the moderate achievement notwithstanding, more still needed to be done.

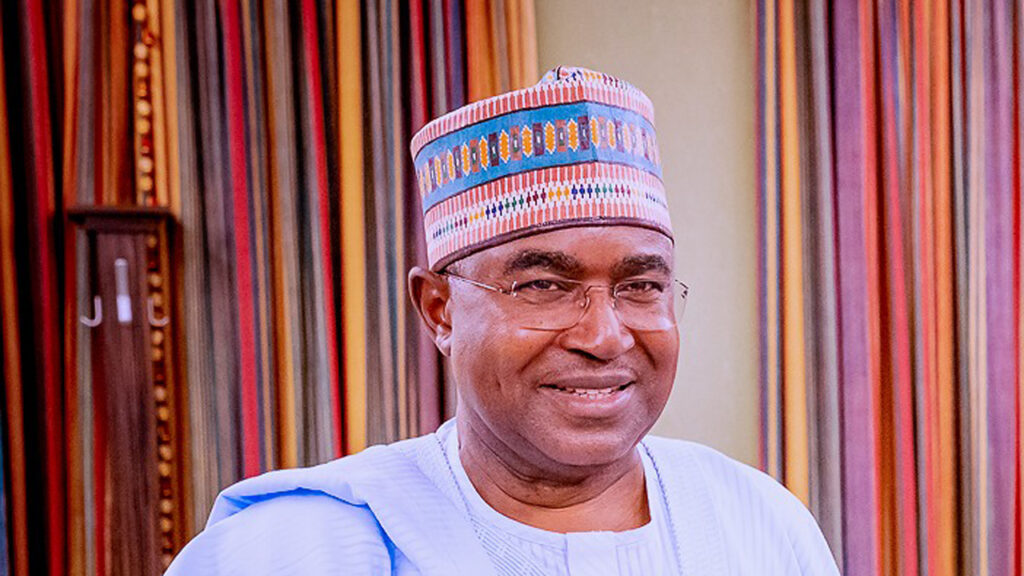

A panelist and Chief Executive Officer of Sterling Bank, Abubakar Suleiman, said last year’s financial inclusion growth came with mixed results due to the pandemic.

He advised that the demographics excluded from the marginal growth should be looked into, adding that the objective of financial inclusion, which is to create prosperity, must be religiously pursued.