Towards ensuring economic stability among families, experts have emphasised the need to create wealth and double less than 15 per cent home ownership rate in the country.

They stressed the need for the acquisition of assets towards building generational wealth for self and generations, reorientation, improved mortgage, deploying vertical building designs and ensuring public-private partnership in the housing sector.

The expert spoke at a housing summit entitled: “Building Wealth through Home Ownership” organised by Stanbic IBTC bank, in Lagos. The bank’s Executive Director, Olu Denalo, who led the discussion, said the homeownership rate among Nigerians was still low, accounting for about 15 per cent despite the importance of housing in guaranteeing individuals’ security.

He cited data that shows that 65 per cent of Americans own their homes, in Canada 60 per cent, in Europe 70, while in Nigeria about 15 per cent of the population owns their homes, saying that there is a need to encourage more Nigerians to purchase their own homes through mortgage.

Managing Director, Urban Shelters Ltd, Hajiya Saadiya Aliyu, reiterated that for long-term wealth generation, people should invest in property.

She observed that home ownership unlocked a plethora of opportunities such as equity acquisition, asset management, portfolio diversification, and rental income.

The Managing Director, Design Union, Mr Anthony Aihie, said building wealth through the property ladder must come with economic considerations of housing affordability, family settings, and the ability to commute easily.

Speaking on steps to take towards home ownership for first-timers, Executive Director, Enterprises Services, Lagos State Development and Property Corporation, Adeniyi Aromolaran, said there is a need for reorientation of homeowners to opt for partnerships rather than individualistic endeavours.

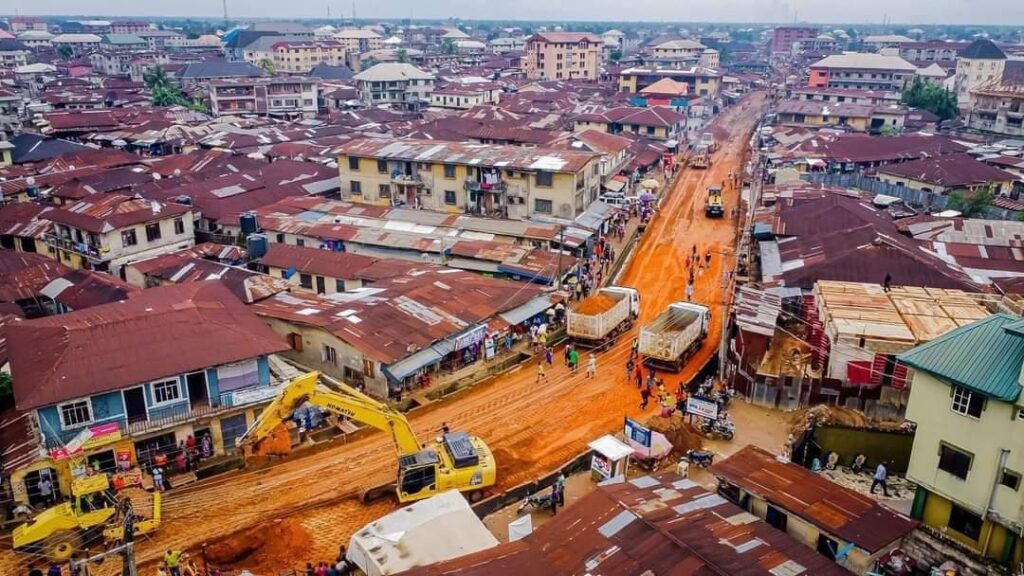

He said: “We can no longer build flat, we need to build up. Must you build a five-bedroom flat that you cannot easily convert when the need arises to prove that you are wealthy? There must be deliberate saving culture.”

The Chief Executive Officer, RESE Advanced Technologies, Folajimi Ogunsiakan, said home ownership contributes to quality of life and financial stability. According to him, a crucial point about housing affordability is to remove ego but be practical, pragmatic and focus on wealth creation.

In his keynote address, Lagos State Commissioner for Housing, Moruf Akinderu-Fatai, represented by the Permanent Secretary, Abdulahafiz Toriola, said shelter is critical to everyone, while home ownership is the passport for wealth creation.

However, he listed challenges faced in the quest to own homes as high property cost, scarcity of land, especially in Lagos, high interest rate, stringent mortgage system, and economic instability among others.

With limited resources, he harped on public-private partnerships by all stakeholders to further bridge the deficits in supply,. He revealed that the state government has offered a 40 per cent rebate on all permits for private developers willing to come into the built environment and partner with the government.

Toriola said the state government looked into the opportunity to create wealth through housing and has completed and delivered 39 estates across the state.

The government, he revealed has launched various affordable housing schemes to provide housing at subsidised rate for the low, medium and high-income earners, as well as introduced an open balloting system to drive accessibility to homes and mortgage schemes.