• Budget implementation still major concern

• International bond market closed to Nigeria, other African countries

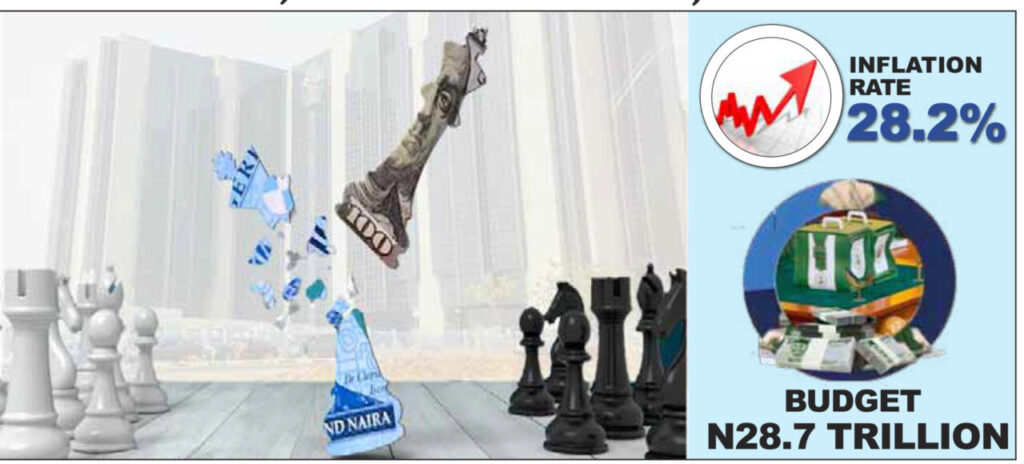

• Fresh FX crisis threatens outlook of naira’s medium-term stability

• Fiscal deficit rises by nearly 1,500% in 10 years

Nigerian economy may have been, excruciatingly, ensnared in a doom loop with entrenched runaway inflation, troubled currency market, upsetting deficit funding crisis, persistent pressure on local businesses and similar warning indicators halting a few but haphazard moves to create flywheel and break the circle.

Indeed, the sort of difficult times Nigeria finds itself in recent years requires the desperate actions seen in the past six months under the current administration except that quick fixes are, themselves, fuelling the self-reinforcing downward spiral, data analysed by The Guardian suggest.

Like the previous administration, President Bola Tinubu has a two-pronged fiscal strategy to return the country to the path of recovery. First, it wants to raise the level of public revenue.

Then, (albeit a more passive option) it hopes that a modest growth (six per cent if the President sticks to his election campaign gun) returns to reduce the level of unemployment and raise the confidence level, which is currently feeding the negative loop.

However, the problem is that measures employed in the first layer of the strategy could make achieving stage two not likely in the life of the administration.

There is already what appears like a contrived faith in the administration’s capacity to grow revenue. First, there is a promise-policy contradiction from the circle of the administration.

The puzzle labelled 2024 budget appropriation, for one, is a harbinger of the inconsistency. The budget suggests the government will scout N9.2 trillion from the largely inaccessible or extremely expensive debt market and elusive sale of public assets to plug the gaping hole in the expenditure plan.

That the government aspires to still borrow that much contravenes an earlier promise by the Minister of Finance/Coordinating Minister of the Economy, Wale Edun, to the effect that the administration would not rely on debt funding but would create a mix of innovative financing options to deliver on its mandate of ‘Renewed Hope’.

After the President signed the budget at the dawn of the new year, Edun, in self-commendation, applauded the cabinet for scaling the fiscal deficit to output ratio from 6.1 to 3.8 per cent. Whereas it is a decent improvement, both positions are flagrant violations of the Fiscal Responsibility Act (FRA), which sets the threshold at three per cent.

Here is a clearer desperate move of the administration that also raises questions about the administration’s readiness to wean the country from the risk of a debt trap. A report said the government would pay 11.85 per cent as interest on a $3.3 billion pre-export finance facility facilitated by the Nigerian National Petroleum Corporation Limited (NNPCL) and backed by 164.25 million barrels of crude.

There are other vaguely documented asset-backed loans, which the President of the African Development Bank (AfBD), Dr Akinwumi Adesina, has warned African countries against. But the recent African Export-Import Bank (Afrexim) deal raised much dust for the premium in interest rate the country will pay – about four per cent points higher than what Ghana paid for a similar deal.

The government may have been able to get away with some sympathy on the ground that the mess it sought to clean when the deal was finalized last year was caused by another administration.

When the deal was sealed, the facility was touted as a game-changer in the foreign exchange (FX) equation, at least, in the short term. But two weeks after the first tranche has been received, the loan has not moved a needle in the troubled FX market.

Last week, the dollar closed at over N1000/$ milestone for the third time in less than a month, jolting optimistic views on the ability of the naira to weather the storm in the months ahead.

At the parallel market, speculators who were held back by government assurances are gradually returning, pushing dollar to near N1,250/$ at the weekend. Some experts now eye N1,350/$ as a ‘death cross’ that could trigger another round of self-fulfilling prophecy like the one witnessed around mid-last year.

A falling naira, historically, is like a falling knife on Nigeria’s economy with consequences for inflation, poor corporate performance and unemployment. These have the potential to feed the doom loop and pull down one elevator, a reason some exchanges think the first port of call in fixing the economy is addressing the FX distortions.

Last year alone, dozens of companies, including GSK Nigeria, Evans Medicals, P&G and Unilever pulled out of Nigerian manufacturing space, partially or completely, turning the country into a marketing outpost. They were forced to take FX-related haircuts. Some indigenous companies, who are compelled by limited options or sheer patriotism to stay, as narrated by the Chief Executive of May & Baker Nigeria Plc, Patrick Ajah, have scaled down their operations, cutting down jobs.

But it is not only jobs that have been affected – also tax revenue cuts. In 2022, GSK paid a total of N333.2 million in income tax. That appears like a drop in the ocean but the picture of how much the government loses yearly to such exit is clearer when one considers how regular such corporate announcements are now rolled out.

As companies quit, thousands of workers, whose pay as you earn (PAYE) is remitted to governments monthly are also laid off, making them a potential burden on government, at different levels, and unable to contribute to the common purse, a major threat to non-oil revenue drive that also pushes up fiscal deficits.

The challenge of fiscal deficit is even less about estimates and much of the gaps between projections and performance. Besides 2016, the federal government had exceeded its projected fiscal deficits in the past 10 years when the yearly shortfall between revenue and expenditure rose from N880 billion to N13.8 trillion or 1,468 per cent. Last year, the difference between the projected and actual fiscal deficit was over N7 trillion. Analysts at Afrinvest Group are also projecting the figure to reach N13 trillion this year.

Certainly, Tinubu is not assessed from the old lens. For one, he achieved remarkable success and broke barriers in internally generated revenue (IGR) as a governor of Lagos State. Some commentors, thus, are optimistic the stagnation in revenue could reverse in the coming years and improvement expected in budget performance.

Sadly, the 2024 budget parameters tend to mimic what is supposed to be a dying culture – overambitious oil production and price benchmark, ambiguous or unambitious non-oil revenue projections and what many have described as uncreative benchmarking.

Founder of Comercio Partners Limited and investment banker, Steve Osho, admitted it would be a tough year, especially with the task of managing delicate balancing “economic growth and managing inflationary pressures”.

“While initial reform measures were promising, the persistence of FX challenges, uncertainties in the oil sector, high inflation and governance issues create headwinds for investors. Backtracking on key reforms and the widening gap between official and parallel exchange rates contribute to an environment of uncertainty,” he noted while assessing the country’s economic outlook.

On the crude market outlook, Afrinvest analysts projected: “We expect domestic crude output to derail budgeted oil revenue in 2024. Also, our model suggests that the budget deficit should exceed ₦13 trillion, while annual GDP growth should print at about three per cent in a base case as against FG’s 3.8 per cent projection.”

The Guardian had reported that the parameters such as oil benchmarks that leave little room for price shock and production cuts have raised concerns on the workability of the budget, which was expected to send a strong statement on a new dawn in macroeconomic management.

Growing deficits have pushed the government into a debt crisis that is being turbocharged by an unbearable debt service to revenue ratio, which the World Bank said could reach 160 per cent in 2027, refinancing and restructuring vicious circle such as the sour Central Bank of Nigeria’s (CBN) overdrafts.

In the 2024 budget circle, N8.2 trillion – 29 per cent of the total spending envelope or 42 per cent of the expected retained income of the government is earmarked for debt servicing. That close to 30 kobo out of every N1 the country will spend this year is planned ab initio for servicing debt obligation underpins the enormity of the challenge at hand.

Still, this would not be much of a problem if the money came cheap. From local to international markets, governments break the rocks to source money as the days of cheap money seem to have long gone.

For instance, no country in sub-Saharan Africa (SSA) raised money from international bond issuance – the first time it would happen since 2008 or 15 years ago. SSA, including Nigeria, raised an average of $10.3 billion yearly from international bond issuance from 2014 to 2022. The drying international debt, marked as the unaffordable cost of funds, means more trouble for Nigeria and other countries that are trapped in deficit budgets – perhaps a reason the federal government jumped at the Afrexim-arranged crude-backed debt, even at a double-digit interest rate.