• Experts expect CBN to raise interest rate next week

• Experts expect CBN to raise interest rate next week

• High-interest rate hurting economy, warns CPPE

• Economists say fiscal authorities not doing enough

The cost-of-living crisis confronting the majority of Nigerians may have further worsened as inflation hits another new height in close to three decades.

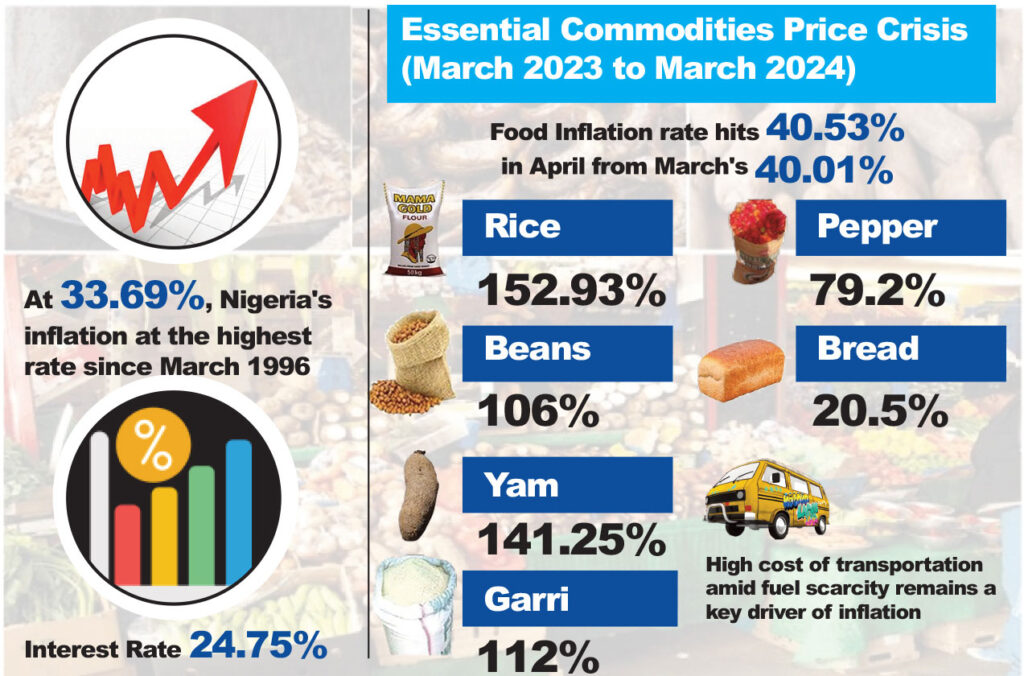

The headline inflation, in March, edged up to 33.69 per cent just as food inflation remained well above 40 per cent, according to the consumer price index (CPI) reading released yesterday by the Nigeria Bureau of Statistics (NBS).

The figure, which is the highest since March 1996, shows how much Nigerians have been pushed to the brink as they struggle for survival amid soaring prices of food and commodities.

Some parts of the NBS data, however, showed some positivity. The figure slowed down to 2.29 per cent on a month-on-month basis, the first time this year.

The food year-on-year at 40.53 per cent also slowed down to 2.5 per cent month-on-month, which is another first in 2024.

Month-on-month slowdowns are seen in food and non-alcoholic beverages, clothing and footwear, housing water, gas and fuel, health, recreation and culture, education, restaurants and hotels and goods and services.

However, alcoholic beverages, tobacco and kola; furnishings;transport and communication, all have their prices surging upward.

The Central Bank of Nigeria (CBN) had raised monetary policy rates by 400 and 200 basis points in February and March respectively, lifting the key lending rate to 24.75 per cent, all to tighten liquidity and ostensibly control what might be described as ‘stubborn’ inflation that has accelerated consistently over the last 15 months.

Despite all that, the nation’s headline inflation rate has continued its upward trajectory, hitting an all-time high of 33.69 per cent in April, an increase of 0.49 per cent points when compared to the March 2024 headline inflation rate.

Interestingly, on a month-on-month basis, the headline inflation rate in April 2024 was 2.29 per cent, which was 0.73 per cent lower than the 3.02 per cent recorded in March 2024.

Food inflation, which has been on a free ride, has soared to 40.53 per cent from 40.01 per cent in March 2024.

A careful study of the April inflation figures showed that beyond the high exchange rate and high liquidity, the drivers of inflation in Nigeria are structural, requiring more than just monetary policy to control.

The high cost of transportation, which rose by 79.17 per cent in March this year and insecurity that has made it difficult for farmers, especially those in the northern part of the country to go to their farms, thus creating food shortages, are said to be the main drivers of the inflation.

Other drivers include high energy costs following the increase in the prices of fuel and diesel and the epileptic power supply that has forced manufacturers to rely more on diesel for their production activities as well as multiple taxation as the government struggles to raise more revenue to finance its budget.

The result of all these is that more and more Nigerians are being pushed into poverty. Just recently, the Nigerian Red Cross society during this year’s World Red Cross Day raised the alarm that over 30 million Nigerians are facing starvation and called for urgent action to save the situation.

On Tuesday, the United Nations Resident and Humanitarian Coordinator for Nigeria, Mohammed Fall, appealed for urgent action to save about 5.9 million Nigerian children who face severe food and nutrition crises, a figure believed to be the highest globally.

President Bola Tinubu in July last year declared a national emergency on food security, as record inflation made basic foods unaffordable for many. Ten months later, the situation has even worsened with prices of basic food hitting the rooftops. For instance, the NBS report on the prices of selected food items for March 2024, showed that the price of rice rose by 152.93 per cent, beans by 106 per cent, garri by 112 per cent and yam by 141.25 per cent in the last year.

The NBS also reported that it now costs more to prepare a healthy diet with the national average rising to N982 per adult per day in March 2024. This is 4.7 per cent higher than the amount recorded in the previous month of February 2024, which was N938.

Experts said the challenge is that Nigeria still relies heavily on imports to meet the daily needs of its citizens. So, it is easily affected by external shocks such as the parallel foreign exchange market that determines the price of goods and services.

While economists argued that the monetary policy measures adopted by the present CBN leadership to address inflation are rather pushing the nation deeper into the inflationary zone, the CBN governor, Olayemi Cardoso, seemed undeterred as he told Financial Times in a recent interview that interest rates would stay high for as long as necessary to tame inflation.

While conceding that inflation was higher than he had hoped, the CBN governor blamed it on what he called ‘distortions’ mainly because of high food prices, saying, “That is something that is not directly within our control.”

He noted that the Monetary Policy Committee (MPC), which he chairs, would adopt appropriate measures to tackle rising inflation.

“They will continue to do what has to be done to ensure that inflation comes down,” Cardoso said.

A fiscal governance expert and lawyer, Eze Onyekpere, said the economy is made up of so many sectors regulated by policy frameworks. He noted that focusing reforms on monetary policy alone while ignoring the inherent contradictions in fiscal, trade, industrial and productivity policies is an exercise in futility.

He said: “Stabilising foreign exchange without increasing foreign exchange inflows is impossible. Refusing to take steps to meet the budget crude oil production quota (our major source of forex) and failing to encourage non-oil exports, implies that monetary policy is bound to fail.”

He said that Dangote Refinery was supposed to add value by refining locally produced crude, but it now imports crude oil, noting that a good part of the advertised gains is now traded away in the circumstances.

For him, complaining about food inflation and doing nothing tangible to control terrorists driving farmers away from the land is not a best practice.

“Essentially, something is fundamentally wrong and it is the failure of governance. It is about a team that is headed west while announcing that they are on their way to the east. Destinations are not determined by announcements but by the direction of your efforts,” Onyekpere said.

Indeed the latest figure of a modest 0.49 per cent is an indication of a slowdown in the cost price index and a signal that inflation might soon peak.

Going by this, an Economist, Kelvin Emmanuel, sees the MPC raising the MPR by 150 basis points at their forthcoming meeting to 26.25 per cent to reduce the yield curve differential and align the inflation to the interest yield curve as a means to reduce the migration of liquidity from naira to dollar-denominated assets in a market that has the black-market premium at 30 per cent.

But Emmanuel was quick to caution that relying on the Central Bank alone to fight inflation with tools like MPR, CRR, and asymmetric corridor, while the apex bank has released guidelines for recapitalization of banks as a tool to increase their asset quality is a bad idea.

He added: “The fiscal authorities need to fundamentally raise revenues from Government-Owned Enterprises (GOEs), especially in oil and gas by moving beneficial ownership and administration to an asset manager that is appointed by the Government. It is difficult to believe that in 2024, the government is recording a 48 per pent deficit financing of the budget, at a time of record oil and gas prices and demand globally, because you’ve a state oil company that has high forward sale agreements, the highest unit production cost per barrel in the world, record oil theft, and low aggregated average less JV cash calls from its Joint Oil Agreements (JOA) and Production Sharing Contracts (PSC).”

In his reaction to the NBS data on inflation, the Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, said though there was a marginal slowing of the rate of rise in inflation in April, the difference is not anything to celebrate.

He said the slowing could be a result of the brief rise in the value of the naira at the foreign exchange market during the month under review.

According to him: “There was also a slight drop in the price of diesel during that month. So that may have contributed to the slow upward movement.”

On the insistence of the CBN to keep interest rates high, Dr Yusuf cautioned the CBN should do a cost-benefit analysis to see if the benefits of high interest rates outweigh the disadvantages.

“For me keeping the interest rates high could significantly hurt the economy,” he said.

This comes as the 295th CBN Monetary Policy Committee (MPC) takes place between 20 and 21 May 2024. The MPC last met on March 25 and 26.

The committee will review the last decisions on monetary policy which was aimed at tightening towards curb inflation.

Apart from raising the monetary policy rate from 22.75 per cent to 24.75 per cent, it also retained the asymmetric corridor at +100 basis points and -300 basis points around the MPR.