A real estate expert has advocated legal and institutional reforms as a means of reviving the nation’s dead capital, unlocking economic potential and promoting inclusive development.

The Managing Partner, Ubosi and Eleh and Company, Mr Chudi Ubosi, who spoke at a Webinar on ‘Reinvigorating Nigeria’s Economic Potential with Dead Capital,’ said a 25 per cent increase in titled land in the country would potentially boost Gross Domestic Product (GDP) by enhancing agricultural productivity, attracting investments, and fostering economic development.

Dead capital, a term coined by Peruvian economist Hernando De Soto, refers to assets that hold potential economic value but are locked away and unable to contribute to the formal economy. He observed that despite individuals owning assets such as land and homes, the lack of legal recognition made it challenging for them to leverage these assets for economic opportunities. His ideas have had a significant impact on discussions about property rights, informality, and economic development globally.

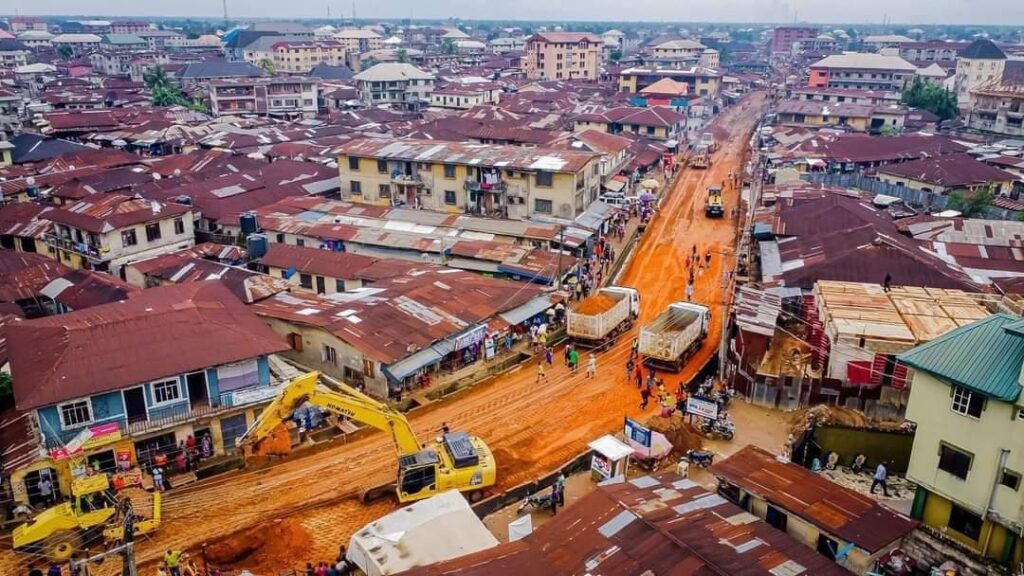

PwC study noted that Nigeria’s dead capital represents a potential value of $9.30 trillion with Nigeria accounting for close to $1 trillion of it in 2020, which manifests majorly in residential real estate and agricultural land. This leaves Nigeria’s dead capital staggering at estimated between $300 billion and $900 billion in vast stretches of land, homes, and properties.

The potential has been stifled by bureaucratic inertia and lack of clear ownership. The high-value real estate market alone is worth between $230 billion and $750 billion. The middle market accounts for an additional $60 billion to $170 billion. These could make a big impact if the country could breathe life into them, propelling their owners toward economic growth, poverty reduction, and prosperity for all.

In Nigeria, about 10 per cent of its entire land asset has titles and fares better than Mozambique and Zambia, which have an estimated 3 per cent freehold land. But Nigeria is behind Namibia with 44 per cent of freehold land and South Africa with the highest proportion of 72 per cent of land under freehold ownership.

Ubosi stated that dead capital is impactful in developing economies, like Nigeria, where a large portion of the population might hold assets informally. “This can create a significant barrier to development by limiting access to capital for entrepreneurship, infrastructure investment, and poverty alleviation initiatives.

“Conversely, unlocking dead capital holds the potential for significant economic growth. By addressing the legal and institutional challenges that prevent formal recognition of these assets, their value can be activated. This can lead to increased investment, credit availability, and overall economic activity,” he said.

The strategies, he proffered include implementing a comprehensive system for clear land titles and registration, which will help formalise property rights, reduce uncertainty and unlock economic potential.

He also said linking land titling with access to credit can incentivise formalisation and empower landowners. “Land registration and documentation processes should even be decentralised to the local councils where the rural people could easily have access. The stress and cost of travelling to the state capital for land matters will also be reduced,” he said.

Ubosi also made a case for strengthening and streamlining legal frameworks related to land ownership can provide a more secure environment for property transactions, encouraging investment and development.

For the estate surveyor and valuer, leveraging technology for land administration, such as digital mapping and blockchain, can improve transparency, reduce fraud, and enhance the efficiency of land registration processes. Ubosi cited the Lagos State government as one of the few states that understand the role of land in economic development.

He said implementing government programmes will address land tenure issues and promote land reform, which can play a crucial role in tackling dead land capital. Ubosi added that addressing customary land tenure systems and integrating them into the formal framework can promote traditional rights, while partnering with private companies and Non-Governmental Organisatons will accelerate land titling and financial inclusion.